|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 7 Bankruptcy in Ohio: An Essential Guide

Chapter 7 bankruptcy, often referred to as 'liquidation bankruptcy,' is a process that allows individuals in Ohio to eliminate most of their unsecured debts. This guide provides an overview of how Chapter 7 bankruptcy works, its benefits, and what you need to know before filing.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is designed for individuals who cannot repay their debts. Upon filing, a trustee is appointed to oversee the liquidation of non-exempt assets, with proceeds used to pay creditors. The remaining eligible debts are discharged, offering a fresh financial start.

Eligibility Criteria

To qualify for Chapter 7 in Ohio, you must pass the means test, which compares your income to the state median. If your income is below the median, you automatically qualify. If it's above, further calculations determine eligibility.

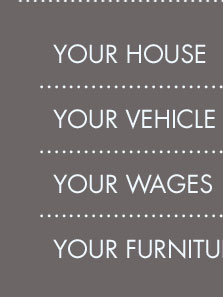

Exempt vs. Non-Exempt Assets

Ohio law allows you to keep certain exempt assets, such as basic household items, some equity in your home, and a vehicle up to a certain value. Non-exempt assets may include valuable collections or additional properties.

The Benefits of Filing Chapter 7

Filing for Chapter 7 bankruptcy in Ohio has several advantages:

- Immediate Relief: An automatic stay stops most collections, giving you breathing room.

- Debt Discharge: Unsecured debts like credit cards and medical bills can be eliminated.

- Quick Process: Typically, Chapter 7 cases are resolved in a few months.

- No Repayment Plan: Unlike Chapter 13, there's no lengthy repayment plan.

Steps in the Chapter 7 Bankruptcy Process

- Credit Counseling: Complete a court-approved credit counseling session.

- Filing the Petition: Submit necessary forms and documents to the bankruptcy court.

- Meeting of Creditors: Attend the 341 meeting to answer questions from the trustee and creditors.

- Discharge: If no issues arise, eligible debts are discharged, completing the process.

Common Concerns and Misconceptions

Some worry that filing bankruptcy might lead to losing everything. However, exemptions protect essential assets. For personalized advice, consider consulting professionals like bankruptcy lawyers in San Jose CA.

FAQs About Chapter 7 Bankruptcy in Ohio

What debts cannot be discharged in Chapter 7 bankruptcy?

Certain debts like student loans, child support, and some taxes generally cannot be discharged in Chapter 7 bankruptcy.

How does Chapter 7 bankruptcy affect my credit score?

Filing for Chapter 7 will impact your credit score, typically lowering it significantly. However, it also offers the chance to rebuild credit over time.

Can I keep my car if I file for Chapter 7 bankruptcy in Ohio?

You may keep your car if it falls within Ohio's exemption limits. If you owe money on it, you can reaffirm the loan or redeem the vehicle.

For those outside Ohio, similar processes apply, and it's beneficial to seek guidance from professionals like bankruptcy lawyers in South Jersey.

Here, you'll find an explanation of Chapters 7 and 13, checklists to help you understand the process and stay organized, and Ohio's property exemption laws and ...

To file for Chapter 7 bankruptcy, your household income must be below the median household income. To find the median household income for your household size, ...

Known officially as chapter 7 bankruptcy, you are able to eliminate your dischargeable debts without making any repayments. Chapter 7. If you qualify, your ...

![]()